There are three broad kinds of insurance policies- term insurance, whole life insurance, and endowment policies. A whole life policy is one in which you pay premium till the death of the insured. An endowment policy is one in which you pay a premium for a specific period and receive a payout in case of both death and maturity. A term plan is for a specified number of years with no maturity benefit. There are multiple variations of these two categories available in the market. Which one you go for depends on your family's financial needs and plans.

What exactly is a term plan?

A term insurance policy is a plan that pays the sum assured in the policyholder passes away within the policy term. Term plans provide a much higher coverage at a relatively low premium. However, if you live out the entire policy term, there is no maturity benefit. Since there is a death payout only, it is advisable to go for as long a term as policy. A term plan is designed purely for protection of family. The death benefit they receive will be high enough to take care of their expenses adequately. This makes it the perfect choice if your family is financially dependent on you.

If you haven't been insured yet, you can check out the Canara HSBC iSelect Smart360 Term Plan. It can be easily bought online, and offers the option of increasing your cover by 25% every 5 years. This way, your sum assured can increase by 100% in the policy term and your family can be secured even with rising costs.

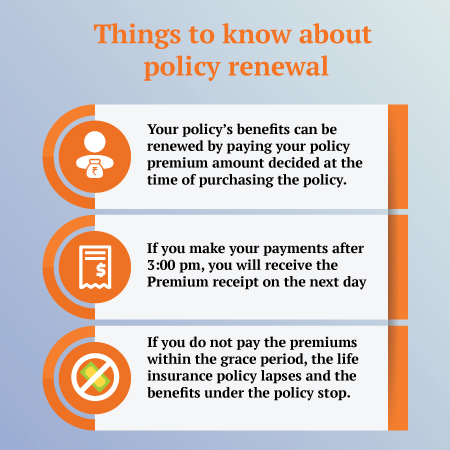

Benefits of term life insurance renewal

3 Key Benefits for Renewal of Life Insurance

Continued security for the family

The main purpose of a term insurance policy is to provide security to your family in the event of your death. However, if your policy matures and you don't renew it, it lapses and your family loses the security you have been paying for all this while. Non-renewal essentially defeats the purpose of term insurance.

Paid-up benefit

A term insurance policy generally has no savings component. It is a pure life cover. If the policy matures and you do not renew it, you receive no return for all the premiums you have paid. Your paid premiums essentially become a loss. If you go for term insurance policy renewal and keep paying premiums, it extends your cover for premature death. Your family remains assured of their financial well-being in your absence. Moreover, the premiums are also minimal. So it should not be a huge financial burden to pay it regularly.

Avoiding extra costs

When you first buy a term insurance, a lot of factors like your age, medical history, family situation, etc. are taken into consideration. If you simply opt for term insurance policy renewa, you might not have to go through the entire process again. You might have to undergo medical tests again, but this depends on your insurer. However, if your policy lapses, you will have to go through the entire procedure again and could end up paying more by way of interest, higher premium amount, etc. Many a time, people stop paying term insurance premiums because there is no paid-up value. The policy then lapses, and they lose all the premiums they have paid. Then they have to opt for a new policy which ends up costing them more.

Tax benefits

Premiums paid for an insurance policy are tax-deductible under Section 80C of the Income Tax Act. If you stop paying premiums in order to save money, you also lose out on the tax benefit and might end up with a greater taxable income. The death benefit of a term insurance policy is also exempt from tax under Section 10(10D) of the Income Tax Act.

If you have been thinking of a term insurance policy and haven't zeroed in on one yet, make sure you check out the Canara HSBC iSelect Smart360 Term Plan. It offers optional cover for accidental death and accidental total and permanent disability.

Term Insurance - Top Selling Plans

Canara HSBC Life Insurance offers online term insurance plans to secure your family financially in your absence.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Family Shield: Enhanced Protection

- Affordable prices

- Multiple premium payment option

- Get Tax benefits

- Hassle-free purchase process

Recent Blogs

Popular Searches

- Types of Term Insurance

- iSelect Smart360 Term Plan

- Term Insurance Plan

- 1 Crore Term Insurance

- 2 Crore Term Insurance

- 5 Crore Term Insurance

- Single Premium Term Plan

- Term Insurance Calculator

- Canara HSBC Life Insurance Young Term Plan

- Term Insurance Tax Benefit

- Term Life Insurance Vs Life Insurance

- Term Insurance For 50 Lakhs

- Zero Cost Term Insurance