Insurance is a contract where the insurer accepts a specific amount of risk for a specific amount of premium cost. How you enter into this contract with an insurer is a step by step process which involves the assessment of the following two factors: Financial capacity or Human Life Value and Individual risk of illness & death.

Human Life Value

The financial capacity or human life value will define the maximum amount of life cover you can purchase with the life insurance plan. This factor majorly depends on your annual take-home income and stability of your occupation. However, factors like the number of dependents, location of residence etc. may also have a say in the overall value.

Usually, your total human life value is 10 to 15 times your annual take-home income.

Individual health & life risks

Health and life risks are the factors which influence your life-expectancy and thus the chances of claim within the policy term. The higher the chance of claim the higher the risk to the life insurer.

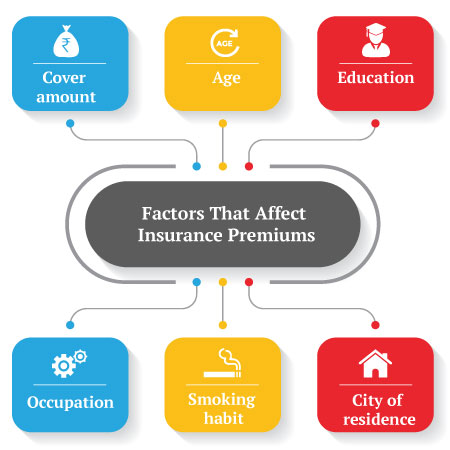

Following factors will influence your health and life risk, or life-expectancy:

- Pre-existing illness

- Physical ailments like, disability, dwarfism

- Congenital deformities

- Other Health issues including family health history

- Lifestyle choices like alcohol consumption and smoking habits

- Occupation type – few occupations like transport, fieldwork into mining, construction etc. carry higher risks than desk jobs such as writing, accounts and banking

Other factors which may have some influence on the general life-expectancy are the state of residence etc.

What does the normal premium include?

The standard premium rate that you will arrive at using the online term insurance calculator is the general premium for a person matching several factors with you.

The standard premium does not assume or consider any of the personal risk factors which may apply to your life but not others. Few examples would be your and your family’s health history, pre-existing health conditions, etc.

When does the insurer revise your premium?

After you deposit the standard premium, you need to complete the application form and go through a medical check-up. The application form will pick up any information about your personal risks which are known to you. Rest of the health risks will be assessed during the medical examination.

Based on all this information the insurer will assess your personal risk for the life cover and any addon covers you have selected. The insurer may revise your premium estimate, or the life cover provided if:

- Higher Risk Assumed by the Insurer, due to a health condition or family history, etc.

- Lower HLV estimate due to occupation or other conditions

If only your HLV is lower, the insurer will reduce the policy sum assured instead of changing the premium amount. However, if the insurer considers you to be higher risk but your HLV estimates are good, you can secure the cover with a slightly higher premium.

What to do when your life insurance premium is revised?

When your premium is revised, you are expected to deposit the difference and avail of the policy. Ideally, this is exactly what you should do, as going to another insurer with the proposal is only going to take time. Chances are the other insurer will also revise your premium quote based on your personal risk profile.

Should you revise your information in the proposal form?

Life insurance is a contract of trust. Unlike a normal business contract, life insurance requires full disclosure from both parties. You can find everything about the life insurance company on their website or with the regulator. While applying for life cover, it is your responsibility to declare every relevant information as correctly as possible for you.

If you happen to hide important facts which may influence your premium or life cover estimates, you may face the following issues:

- Rejection of proposal

- Rejection of claim

- Blacklisting of your application

Rejected life insurance proposals reflect badly on your trust record with life insurers and they may refuse insurance to you at all. Also, if the risk on your life is higher it is all the more important for you to have a life cover as soon as possible.

So, don’t worry about a Rs 1000 increase on your annual term insurance premium, your family would still be better off with this little outflow.

Term Insurance - Top Selling Plans

Canara HSBC Life Insurance offers online term insurance plans to secure your family financially in your absence.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Family Shield: Enhanced Protection

- Affordable prices

- Multiple premium payment option

- Get Tax benefits

- Hassle-free purchase process

Recent Blogs

Popular Searches

- Types of Term Insurance

- iSelect Smart360 Term Plan

- Term Insurance Plan

- 1 Crore Term Insurance

- 2 Crore Term Insurance

- 5 Crore Term Insurance

- Single Premium Term Plan

- Term Insurance Calculator

- Canara HSBC Life Insurance Young Term Plan

- Term Insurance Tax Benefit

- Term Life Insurance Vs Life Insurance

- Term Insurance For 50 Lakhs

- Zero Cost Term Insurance