You try to save the money you earn so that you can fulfil the present needs and achieve larger financial goals in future. But saving money is not enough, you need to invest the money and earn a good return on it.

It can be difficult to achieve long-term goals if you are not investing. Investing allows your money with the power of compounding so that your wealth grows with time.

What is ROI?

ROI or return on investment is the rate of growth your invested money receives over a specific time.

For example, if you invest Rs 100 and one year later receive Rs 110, your money has grown 10% in one year. In other words, your ROI on Rs 100 has been 10% per year.

ROI also measures the performance of the investment options.

For example, if you have two different places you can invest your savings in, ROI will help you decide quickly. Look at the ROI of both investments for the same period and you can invest for a higher rate of growth.

Thus, in the investment world ROI is a method to ascertain the profitability of your investment. You can use this metric to compare investments and choose a better one. ROI for a fixed income investment will tell you the return you can expect from the investment.

Different Investment Options to Consider

Gone are the days where you just used to have only 1-2 options to invest in. Now you have a huge range of investment products at your disposal.

Some popular investments are as follows

1. Stocks

2. Equity mutual funds

3. Bank FD

4. Real estate

5. ULIP

6. Savings Plan

7. NPS

Each investment has different features and thus offers different returns.

Thus, it becomes important to compare the investments so that you can choose the one which will be the best for you.

How to Compare Different Investments?

The following methods can be used to compare two investments together.

1. Pay-Back Period

It is the simplest way to compare two investments. It helps you to determine in how much time your investment will be recovered.

i. It can be calculated as Payback Period= Total Investment/Cash flow per year

ii. The lower is the payback period, the better is the investment.

iii. It is calculated in years.

For example, you have invested Rs 1,00,000 and the return per year is Rs 10,000 then PBP will be 1,00,000/10,000 = 10 years.

2. Time Value of Money (TVM)

The money that you have today may not be worth as much a year later. The value of money today will be worth more than tomorrow. This is the time value of money.

Future Value= Present Value x (1+R)N

3. Net Present Value (NPV)

This is the extension of the concept of the time value of money. It expresses the present value of all the future cash flows that you will receive from your investment.

i. To calculate NPV, a ‘discounting rate’ is used.

ii. A positive NPV indicates that the investment can be considered

iii. NPV uses the concept of the time value

NPV= Rt / (1+ i)t

Where Rt is the value of cash flow at the time ‘t’ and ‘I’ is the discount rate.

This method allows you to evaluate multiple cashflows, coming in or going out, at different points in time.

4. Internal Rate of Return (IRR)

It is a method in which the return is calculated excluding all the external factors, such as inflation rate, bank rate, etc.

Under this, the NPV is considered to be 0.

IRR = Ct / (1+ r)t- Co

All the above-stated methods of comparing the investments involve complexities. It can be confusing especially when you are just starting. Here is one more method which you can use.

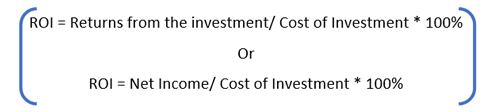

Formula to Calculate Return on Investments

Return on Investment compares the incomes received from the investment with the cost of the investment.

Below is the formula for ROI

- ROI can be positive, negative, or zero

- ROI is always denoted as a percentage

Steps to Calculate ROI

Now that you know what is ROI, you must be wondering how to calculate it. Here we show you the steps you can follow to arrive at your investments Return on Investment.

1. Determine the Cost

The cost of your investment is the total sum you have incurred for the investment. Say you have invested in an equity mutual fund, for Rs 1,00,000.

Thus, the cost of investment is Rs 1,00,000

2. Ascertain your Net Income

The net income earned from an investment is the return you get less other expenses, interest, and taxes.

For example, let’s say you have invested Rs 1,00,000 in a mutual fund. Now after a year, your fund’s value has risen to Rs 1,30,000.

Then Income- Rs 1,30,000-Rs1,00,000 = Rs 30,000

Now suppose the charges are @ 2%. Then after deducting charges, you arrive at your net income which is Rs 29400.

3. Divide your Return with the Cost

In the final step, you just have to divide the income by the total cost. After dividing, multiply it by 100% to get the percentage ROI.

Following the example, the ROI would be Rs 29400/100000 * 100 = 29.4%

Calculate ROI Through Calculators

You don’t have to manually do these calculations. To ease your work, there are many calculators available online which can do the work for you.

For example, Canara HSBC Life insurance company has a Power of Compounding Calculator.

Enter details such as

- Amount invested

- No. of years

- Rate of return

- Click on Calculate

The site will show you in the graphical form your return.

Here we provide you ROI examples of two of the most common investments

- ULIP

- Bank FD

Click here to use - Investment Calculator

How to Calculate ROI for ULIP?

Ajay buys a ULIP to get the benefits of both investment and insurance.

- He pays Rs 1,50,000 every year for 15 years towards the premium of ULIP.

- The maturity value he wants is Rs 50,00,000.

- Now to make sure he receives this amount; his investment must earn at least a 9% return.

How to Calculate ROI for Bank FD?

Bank FD is seen as the safest form of investment. In a Bank FD, you put lump sum money in your account for a fixed duration. At the end of the FD, you receive your original sum with the interest compounded.

For example, suppose the rate offered by the bank on Fixed Deposit is 6% per annum.

- Banks compound the interest quarterly i.e., every 3 months.

- The effective rate becomes 6.14%.

- After deducting TDS of 10 per cent. The effective return for you as an investor will be 5.52% per annum.

- So if you invest Rs 100, after one year you will receive Rs 105.52.

Evaluate the Returns Before Investing

Using these ROI estimation ways, you can now evaluate different investment options before investing. However, do keep in mind that most of these investments are bound to the market scenarios as well. Thus, looking only at ROI is akin to looking only at one side of the coin.

Better have a look at the market conditions as well before concluding.

Disclaimer: This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Financial Planning - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 Plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs