Even if you have a large inheritance and perhaps do not need to earn money actively, you still need good financial decisions to protect your wealth. Not only this, but you have many compelling reasons to consider life insurance, regardless of your financial status:

1. Covering the cost of death, disability or terminal illness

2. Buffering the period of transition for the family after the death of the primary breadwinner

3. Preserving the family’s financial fortune

4. Passing on the legacy to the next generation

You save money primarily for financial and medical emergencies, ensure a bright future for the child, meet larger financial goals, have a comfortable retirement, and to leave a legacy/inheritance for the next generation.

However, it is unlikely that you can prepare adequately for all of these things with just your first paycheque. Emergencies are not predictable and can even cause trouble for the wealthiest of the lot. So does retirement if you are not careful.

Cost of Death

The death of a family member causes tremendous trauma and emotional loss to the surviving family members. The emotional scars are irreparable, irreversible and very deep. To add to the woes, if the departed soul was the sole/major breadwinner of the family, the household could plunge into a financial crisis

Unpaid rents, school fees, lifestyle costs and even basic household maintenance will become a challenge. Look at Karthik’s case below.

Karthik, aged 37 years, died of massive cardiac arrest, caused by tremendous stress at work. He has left behind his wife, 2 children aged 7 years and 4 years. He was earning an annual income of Rs. 10 lakhs and had accumulated savings of Rs. 25 lakhs.

His demise has left a vacuum in their hearts as well in the bank account. The family is perplexed. How will they manage and for how long? The cost of death is huge.

Cost of Death = Loss of Income + Opportunity Cost

… because children will lose opportunities to get quality education and build strong careers.

The loss of income will degrade the quality of life as Karthik’s wife will not be able to sustain the lifestyle with meagre savings.

Before Karthik’s demise, she was planning to attend a skill development program that could help her start a career. The plan was to build a parallel income source in future when the kids would grow up. But all these plans have now shattered, and survival has become a priority. She sometimes wishes, ‘what if Karthik had invested some money in life insurance?’

Accidental Injuries and Death

Accidents and terminal illnesses are another expensive set of emergencies. Inflation in healthcare costs is higher than average and private healthcare in India is already exorbitantly expensive.

The cost of death from an accident or a terminal illness is usually much higher than in other circumstances. Thus, the family should have additional financial support for such emergencies.

What Will Your Family Need After You?

Every family has the following financial needs. While you will fulfil these and more during your lifetime, it is important that even in your demise these are looked after:

a) Regular income for household and lifestyle maintenance

b) Amount to pay off ongoing debts

c) Amount to meet important future expenses, i.e., child’s higher education and marriage

Providing Adequate Protection to the Family with a Life Insurance Plan

The wealth you have carefully built or have inherited, should not be eroded in case of an unfortunate natural event like death. The purpose of life insurance is to help your family maintain their financial fortune until they can come of age and start making bigger financial decisions.

Yes, you do need life insurance because that is also a type of saving, albeit a smart one. A term life insurance cover can provide adequate financial protection to your family in case of terminal emergencies. This goes straight to your spouse and children to support their living costs and important financial goals.

The best life insurance plans provide every feature to help your family receive adequate financial support when they need it. For instance, life insurance plans from Canara HSBC Life Insurance offer the following:

1. Regular income pay-out from term insurance claims along with a lump sum pay out

2. Regular income pay-out can be increasing to adjust for inflation

3. Premium protection option for saving plans, so that your child has the money you planned even after your early demise. (The insurer pays the remaining premiums in the case of your death.)

4. Chance to increase your term life cover after key life events like marriage, childbirth and home purchase.

Who Needs a Life Insurance Plan?

If you can relate to Karthik, you need life insurance. Insurance should be purchased when you do not need it because you may not get one when you need it the most. If you are young and just started working, this is the right time to sign up for an insurance policy. Premiums increase with age and your future family certainly needs financial cover. If you have dependent parents at home, it is another compelling reason to have an insurance policy in your kitty.

If you are already in your 40’s, insurance could be expensive but still worth the investment. A Rs. 1 Crore Sum Assured policy for a 40-year-old will cost approximately Rs. 18,000 to Rs. 24,000 per annum depending on the tenure chosen.

Is there anyone who does not need life insurance? Practically no one.

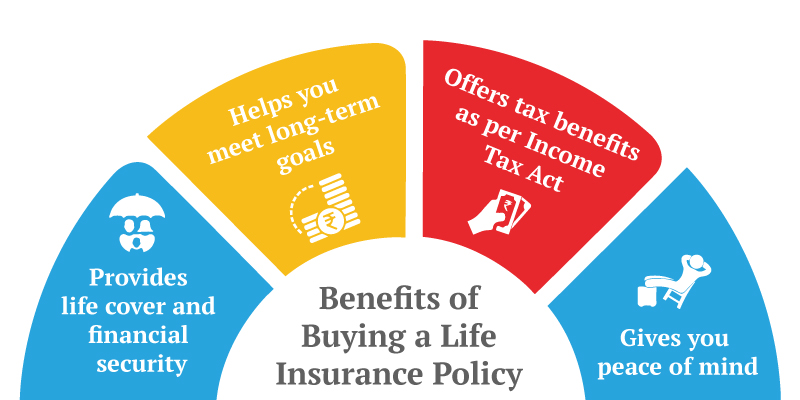

Additional Benefits of Buying the Best Life Insurance Plan

The iSelect Smart360 Term Plan offered by Canara HSBC Life Insurance offers to add on riders such as Accidental Total and Permanent Disability Benefit and Accidental Death Benefit along with the policy. The key advantage is that the Sum Assured is immediately paid out and future premiums are waived off. The other features and benefits continue till the end of the term. This helps the person manage the expenses incurred because of loss of income due to the accident and continues to offer life cover thus giving further assurance to the family.

The Child Support Benefit (CSB) is a unique feature of iSelect Smart360 Term Plan that gives a fixed amount in case you are diagnosed with a terminal illness. This helps your family manage expenses related to a child’s education at different stages in life. This is an add on feature implying that the other benefits of the policy will continue as usual.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium