Providing financial protection, in case of loss of income, due to death is the basic tenet of life insurance. How will the dependants survive if the breadwinner dies? Life insurance is critical in households that have only one earning member and one or more dependants. People hitherto worked only until 60 or 65 because a more conservative India wrongly believed that older people may not be medically fit to work beyond that age. Life insurance policy for senior citizens did not sound logical to actuaries because there was no clear insurable interest .

The demise of a non-earning/retired person would not cause any “loss of income” and hence insurance covers did not make financial sense. This rationale made insurers cap the upper age at 65.

However, a new fast-growing India has given rise to a demand for professionals in the private sector that is shedding inhibitions of age if the person is medically fit and brings talent to the table. This has in turn created a need for life insurance cover for senior citizens over 65 and until even 90. Smart insurance providers have felt this gap and some of the reasons why people aged over 60 may need life insurance.

How a Life Insurance Plan can Help you After you Turn 65?

Take the case of Ramesh who is 66 years old and is working as a CFO for a new age well-funded start-up in Bangalore. The start-up founders hired Ramesh because they wanted an experienced hand to manage their finances. After all, grey hair (or no hair!) are both conventional symbols of wisdom!

Ramesh pays an annual premium towards a life insurance cover and is very clear why he needs it:

1. His wife, Rashmi, is a homemaker and is financially dependent on him. Even though Ramesh had some savings in PF and PPF, he wanted Rashmi to be independent even when he would not be around. Asking kids for money is a strict no-no.

2. Ramesh and Rashmi could not amass too much wealth in their prime time due to various personal commitments. However, they are still keen to leave behind some wealth for their children. A life insurance cover is a good way to bequeath some money.

3. Ramesh had availed of a large personal loan to overcome a temporary setback in life. Although he repaid almost 50% of the loan, he felt that an insurance cover will help in case he dies before the completion of repayment. He did not want to burden his wife and children with debts.

Types of Life Insurance Plans

Life Insurance Plans have also evolved in the last two decades and now offers different variants to suit the diverse needs of a growing aspirational Indian populace.

1. Term Cover

This is the most elementary plan in the life insurance products stable. This is a pure life cover that pays out the sum assured in case of the policy holder’s death.

For example, if Suresh and his wife Surekha are both 65 and working, they can opt for individual iSelect Smart360 Term Plan offered by Canara HSBC Life Insurance or sign up for a joint policy that works out to be cheaper.

2. ULIP Investment Plans

ULIP plans are versatile life insurance investment plans. These plans not only help you invest in diverse instruments for higher growth, but they also have a life insurance cover. These plans are perfect for achieving important long-term financial goals for your family.

3. Guaranteed Plans

Guaranteed plans are also long-term saving plans, except these plans offer guaranteed maturity values. Thus, you will know the maturity value of your investment at the beginning itself. These investment plans are safe investments and help you preserve your wealth.

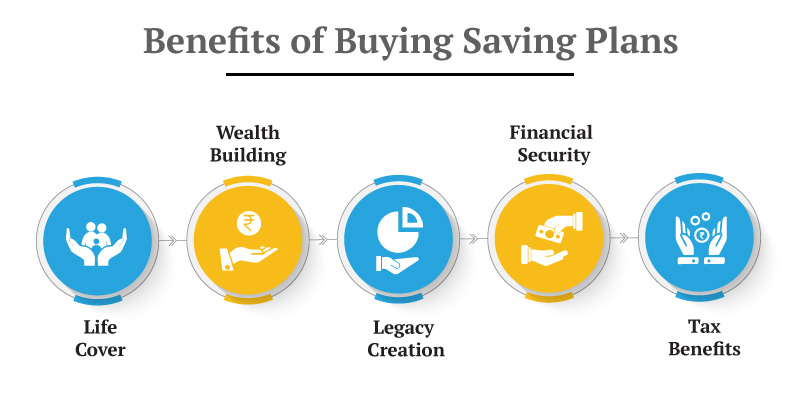

Learn these 6 benefits of buying savings plan with guaranteed income.

4. Annuity Plans

Annuity plans are safe investment plans which help you secure a regular income in your employment free years, i.e., retirement years. You can either start the annuity with a large lump sum investment or invest for a while before starting the annuity. These plans can guarantee lifetime income. Thus, offer financial security during your lifetime.

Life Insurance Plans You Can Buy After 65 by Canara HSBC Life Insurance

Not all of us are going to be lucky enough, or willing enough like Ramesh, to continue working even after 65 years of age. Thus, your life insurance and other financial needs also change, and as a result the need for life insurance. At this age, your life insurance needs changes from entirely protection and tax-saving to income guarantee and legacy.

Thus after 65, depending on your life preferences, you may need the following insurance plans:

a) Term life insurance cover

b) Pension plan with guaranteed lifetime income

c) ULIP plans for tax-free regular income and growing unused corpus

Invest 4G ULIP Plan

Invest 4G, offered by Canara HSBC Life Insurance, meets the most common objectives that you have:

a) Wealth creation

b) Life insurance

c) Regular and tax-free pay outs like pension

d) Leaving a legacy for your grandchildren

Invest 4G is designed to gain from the dynamics of movements in the financial markets to give you superior returns in the targeted period. Even the amounts invested each year are deductible, under section 80C, from your taxable income.

In case of your unfortunate demise, your nominee would receive the higher of sum assured or fund value. There is another option that pays the sum assured on demise and the company funds the future premiums until maturity. The fund value is then paid to the nominee.

Invest 4G is a classic investment cum insurance product designed to give a sizeable corpus in all cases so that you or your family are always financially sound.

Pension4Life Annuity Plan

Pension4life plan is another exciting policy, from Canara HSBC Life Insurance, that gives an income stream called an annuity, at pre-defined intervals, even after 65 thus taking financial stress off your shoulders. The joint annuity options ensure that you remain stress-free about your partner’s expenses in case of your demise. There is another silver lining, around the dark emotional scar, that returns the entire initial investment to the family in the case of your demise or of critical illness or accidental total and permanent disability before the age of 85.

You are the best person to decide whether you need life insurance after 65 because it depends on your circumstances and commitments. However, having an insurance policy will do good than harm. If you decide to apply for a policy, you must compare different offerings and match them against your needs. Every person’s need & situation is unique and therefore you should not generalize the challenges or benefits across all people of similar age.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium