What Do Term Insurance Plans Not Cover?

A Term insurance provides financial protection to your family in case of any unfortunate eventuality. As a beneficiary, your wife, parents or children can receive a lump-sum death benefit in case of demise of the insured during the policy tenure. Even though term plans are among the most affordable and rewarding insurance options one can have, it is better to have complete knowledge about the kind of deaths that are covered under a policy, and also those that are not covered. It is always beneficial to be aware of the terms and conditions of the term insurance policy, to ensure there are no unpleasant surprises waiting for your family members or dependents, when they are already in stress. Term plans are best suitable for planning short to medium term goals. Let’s see what kinds of deaths are typically not covered in term insurance plans in India:

- Death due to driving under the influence of alcohol

- Death due to a pre-existing health condition

- Accidental death due to driving under the influence of drugs

- Death due to the participation in adventure sports

- Death due to the participation in racing events

- Death due to pregnancy and childbirth

- Death caused due to the participation in illegal activities

The above mentioned are certain lifestyle influenced exclusions in a term insurance policy. It is important that you mention about your smoking and drinking habits, if you happen to have them, at the time of application of the policy. Following which an insurance company will typically assess the risk of death due to these habits and may charge an additional premium for the cover. However, hiding the information can lead to problems at the time of claim settlement, causing trouble to your family. And in case the information is revealed after application, the company may cancel your policy.

Also Read - Term Plan Meaning

Apart from these previously mentioned pointers, there are some other conditions that are mostly not cover by a term policy:

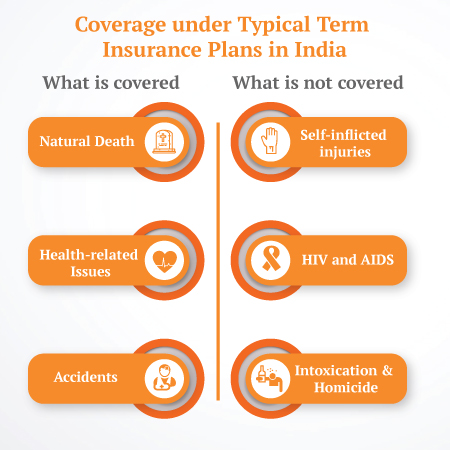

- Self-inflicted injuries: If the cause of death is participation in a hazardous adventurous activity leading to self-inflicted injury, the claim might be rejected by the insurance company.

- HIV and AIDS: Insurance claims made against death due to sexually transmitted diseases like HIV or AIDS are not admissible by the insurance company.

- Natural disasters: Deaths that caused by natural disasters are not covered by the life insurance company. However, there are often riders available to cover these instances.

- Intoxication: Any death that takes place due to the consumption of drugs or alcohol is not admissible and the company has the right to reject its claim.

- Homicide: If the policyholder dies due to a murder, the insurance company has the right to put the claim on hold until the acquittal of the nominee. In case the murder is committed by the nominee, the insurance company will reject the death claim.

In cases where certain hazardous life conditions are predictable by the policy holder, insurance companies may offer riders and additional coverage options. It is advised you flourish all information at the time of buying of the policy. Also, if there is a change in lifestyle after allotment of the life insurance policy, the policyholder should ideally share the information with the insurance company to ensure efficient coverage and easy claim settlement, when the time comes.

Any natural death or death due to health-related issues will be covered by insurance plans in India. With critical illness covers, in case of death of the policyholder due to a critical illness or medical complication, the beneficiary will receive the sum assured as the death benefit. Most term plans also provide coverage in case of death of the insured due to an accident or disability caused by an accident. Moreover, term policies also offer the option of choosing from a variety of additional benefits that promise additional sum assured for specific uses like child education.

Death within First 2 Years of the Policy Term:

For any term life insurance plan, in case an unfortunate event takes place within the first two years of the policy term, the case is considered under Section 45 of the Insurance Act, 1938. It states that the claim will firstly be investigated for fraud, including improper disclosure of information or even misrepresentation. However, after 2 years no claim can be denied on the basis of these grounds. Therefore, the importance of being honest and presenting the correct information with your insurance company cannot be emphasized enough.

The iSelect Smart360 Term Plan by Canara HSBC Life Insurance is ideal for those who have big plans in life and need an insurance cover as flexible as their needs. The plan offers you flexibility to Increase you’re your cover aligned with changing life stages and protection needs at key life milestones, in addition to inbuilt benefits for Accidental Death, Child Support, and Accidental Total and Permanent Disability.

Term Insurance - Top Selling Plans

Canara HSBC Life Insurance offers online term insurance plans to secure your family financially in your absence.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Family Shield: Enhanced Protection

- Affordable prices

- Multiple premium payment option

- Get Tax benefits

- Hassle-free purchase process

Recent Blogs

Popular Searches

- Types of Term Insurance

- iSelect Smart360 Term Plan

- Term Insurance Plan

- 1 Crore Term Insurance

- 2 Crore Term Insurance

- 5 Crore Term Insurance

- Single Premium Term Plan

- Term Insurance Calculator

- Canara HSBC Life Insurance Young Term Plan

- Term Insurance Tax Benefit

- Term Life Insurance Vs Life Insurance

- Term Insurance For 50 Lakhs

- Zero Cost Term Insurance