If you want to move forward from “earning money” to “making money” and becoming wealthy, you must think of ways and strategies to manage your money more effectively. Money and personal finance management can help you keep expenses within budget and invest your money such that you achieve your financial goals.

Money management defines how you handle your money, right from budgeting your expenses to investing depending on your goals.

Money management helps you make the most out of your hard-earned money. It makes the money work harder for you so that you become wealthy in the long run. Money management focuses on reducing debt, investing for your future and optimizing your expenses.

Without effective money management, your personal finance could go haywire. You may end up overspending and struggling to make ends meet even if you earn well. Money management can help you build a better grip on your money so that you can be financially healthy.

What is the Principle of Frugality?

Bootstrapping and working on shoestring budgets are the hallmark of frugality. Deferring expenses that can wait and dropping expenses that can be avoided can save money that can be put to better use.

When you work with constraints, the existing resources are optimally utilized. The money thus saved can work hard in parallel and grow with time. Some pro tips of frugality:

1. Avoid spending for vanity, snobbery or to join the trend

2. Choose the most cost-effective option

3. Spend on interest-bearing avenues

4. Have a clear ROI or a cost-benefit matrix for any desired expenditure

Process of Money Management

Keep a periodic check on where your investments are heading and how much you are adding each month from your income. Put a budget in place so that your spending is under control and more money is invested in building your wealth kitty. A clear process like the one given below can help:

1. Budget:

It does not take much time to prepare a budget. What needs effort and dedication is always sticking to that budget. You may initially find it a bit difficult, but you will eventually develop the habit. Budgeting frees up a lot of money that you would have otherwise spent on unnecessary stuff.

2. Keep Track of Expenses:

Preparing a budget is only scratching the surface of the money management process.

a. You must maintain a clear, comprehendible account of expenses. What is not measured, cannot be monitored.

b. Spend some time each month evaluating your expenses. Where are you spending the most?

c. Ordering food every weekend may look cool, but how much are you paying for the food, taxes and delivery? “Long drives” may seem fun to unwind, but is the fuel bill burning a hole in your pocket?

d. Summing up these expenses will give you more clarity and draw your attention to where it is needed the most.

3. Leisure Spending:

This should ideally be part of your planned budget. However, you can give yourself a small leeway by spending some amount outside your budget. Go and spend occasionally and let this be “outside the budget”. However, let such amounts not be too extravagant.

4. Avoid the Debt Trap:

Banks will offer you loans and credit cards. You don’t have to take them even if you can afford to repay them. The only exception could be emergencies. If you are availing a loan to buy an asset, try investing in an asset that appreciates over time. Buying depreciating assets using loans and credit cards could soon push you into the debt trap.

5. No Impulse Buying:

Evaluate options before you buy anything. Spread the buying decision process over a few days or weeks. Walking into a random shop, while in a mall to watch a movie, and buying something without a second thought is not a financially prudent decision.

6. Invest First, Spend Later:

Income - Savings = Expenses should be your financial mantra. Save money from your income each month. The rest can be used for your monthly expenses. The amount you save should be a well-thought-out and calculated amount. It should align with your short- and long-term goal of reaching a certain corpus.

7. Mitigate Risks:

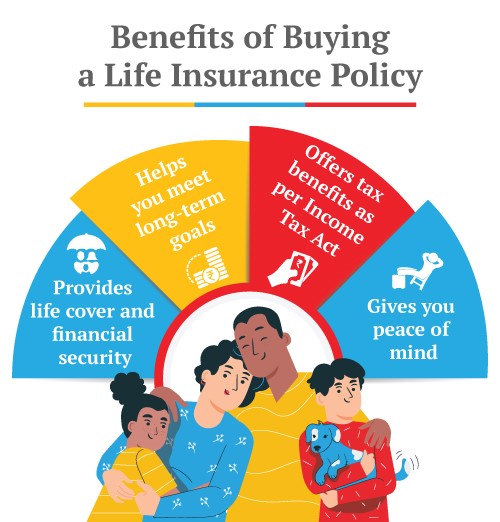

Basic things first. Get a life insurance cover and a health plan besides insurance for your property and vehicle.

8. Plan your Taxes:

Improper planning can cost you loads of money in taxes. If you explore the right investment avenues, you can save taxes on three fronts, namely:

a. At the Time of Investment:

For example, if you invest in an endowment plan or ULIP, the invested amount is deductible, from taxable income, u/s 80C. So, you save tax on the amount invested.

b. At the Interest Accruals:

Accrued interest in the investments could be taxable as is the case with some of the most popular fixed income options. However, the best tax-saving investments will enjoy a tax-free interest accrual.

c. At the Time of Maturity:

No TDS is deducted on maturity because insurance maturity amounts are exempt from taxes in line with the provisions, u/s 10(10D), of the Income Tax Act.

Such investments are also referred to as EEE investments, which stand for three levels of tax exemption.

Efficient Tax Investment Options to Consider

You have multiple investment options when it comes to EEE investments. The following are some of the most important you can use:

1. National Pension Scheme (NPS)

- Invest up to the age of 70,

- Normal withdrawals permitted from the age of 60

- Diversified portfolio investment into equity, debt, and alternate assets

- Automated portfolio management (for asset mix)

- Additional deduction of Rs 50,000 over the 80C limit

2. Public Provident Fund (PPF)

- Minimum investment term of 15 years

- Partial withdrawals are available from the 7th financial year onwards

- Can be extended in 5-year tranches multiple times after maturity

- Returns have a sovereign guarantee

3. Unit Linked Insurance Plan (ULIP)

- Diversified portfolio investment in equity and debt funds

- Partial withdrawals allowed after 5 years

- Investment tenure can range from 5 years to up to 99 years of age

- Bonus additions for long-term investors

- Automated portfolio management options

- Life insurance cover up to 15 times of annual premium

4. Life Insurance Savings Plans

- Investment tenure of 10 years to 99 years of age

- Returns are guaranteed

- Bonuses for long-term investors

- Life cover of up to 25 times your annual premium

At the outset, you may find it difficult to plan and defer purchases you cannot afford with your cash in the bank. But avoid the temptation to spend on your credit card. Save a fixed amount each month first before spending money. Once you build these habits, you will find it easier to save money, generate wealth and have a stress-free, financially secure life.

Disclaimer: This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Financial Planning - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 Plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs