After living and being a salaried employee for a long time, there comes a point in life when people should start considering retirement planning. It is said, “The earlier you start, the better it is.” Because when you start saving for your retirement early in your life, you have the chance to build a significant corpus to help you through your golden days of life when you decide to stop working. A lot of people start their retirement planning by buying the best retirement plan. However, you must consider taking a few steps to ensure that you have everything needed to enjoy a stable retirement lifestyle in the next 10 years or so.

5 Simple Steps for Creating the Perfect Retirement Plan

Let us start from the start. There’s always a plan and strategy behind choosing the best retirement and pension plan. Follow these steps for the perfect retirement plan you are looking for:

1. Make your portfolio well-diversified and invest for the long term

Although it may be tempting to avoid stocks to minimize risk, the potential for growth that stocks may offer is still relevant at this stage of life. Consider keeping a well-balanced portfolio of stocks, bonds, mutual funds, and other investments that meets the risk appetite, investing time frame, and liquidity requirements.

Furthermore, reviewing your revenue sources well in advance of retirement allows you to make the required adjustments to your plans. A well-balanced portfolio will help you survive market downturns and earn the kind of income you'll need to pay costs throughout a retirement that may last for long.

2. Debt reduction is essential

Consider making extra mortgage contributions so that you can pay off your debt before you retire. Paying cash for big transactions will help you avoid incurring new credit card debt. You will reduce the amount of retirement income spent on interest costs by minimizing new debt and reducing current debt.

Surprisingly, paying off a credit card with a 15% interest rate is almost equivalent to earning 15% on a risk-free deposit. You must take a hard look at things to make an effort to get out of debt.

3. Prepare a budget for all retirement income and expenditures

Calculate your predictable revenue from different sources, such as pension from your boss. The majority of your retirement income will most likely come from your salary, pension, and investment accounts, as well as any benefits received after you retire.

Some costs, such as health insurance, may increase as you get older, while others, such as transportation and expenditure on clothes, may decrease. How much you pay in retirement can be determined by how you live. If you want to fly extensively, the estimated expenses will be much greater today when you are still working.

4. Take into account future medical expenses

If you retire at 65 or older, you may want to start purchasing insurance to help offset your non-routine healthcare costs, which are expected to escalate as you age. At an elderly age, ailments and diseases are very common. Therefore, people must have routine medical checkups at hospitals with their physicians and have a health plan with insurance cover.

Learn how to plan for medical expenses during retirement.

Canara HSBC Life Insurance customers can choose from various policies tailored to their specific preferences and conditions.

Try purchasing a long-term care policy to help secure your retirement savings by covering costs such as home health aides. Your premiums will be cheaper if you purchase policies now rather than waiting a few years, and you will be less likely to be turned down by insurers.

Try contributing the full amount to a health savings account if you have one. The money is tax-free, but it can be liable to income tax and fines if it is not spent for eligible medical purposes.

5. Make plans for where you will live

Your retirement location will have a significant effect on your costs. For example, suppose you sell your house in a high-cost area and relocate to a condo in a low-tax state. In that case, your expenditures can drop dramatically, potentially freeing up money for other purposes.

You might still imagine living in your current town or city but downsizing to a more affordable house. On the other hand, you may choose to live in an area with high expenses and taxes to be near your grandchildren, or you may choose to relocate somewhere you can cut down extra costs.

Learn how to plan for your dream vacation house at retirement?

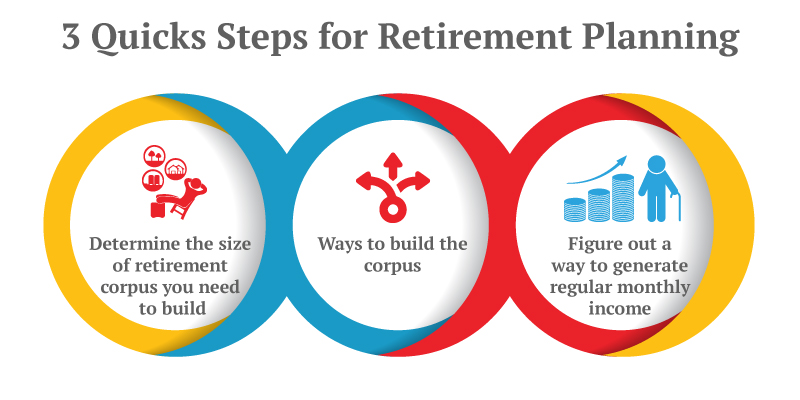

How & What to Figure out Before Taking any Step Towards Retirement?

Begin by visualizing the kind of retirement you desire. Are you planning to work part-time, volunteer, or travel? After that, create a concrete view of the financial tools you'll need or see if the existing ones will be enough to carry out your retirement smoothly.

Consider how you can acquire the additional assets you need or change your current situation in a way that fills the void and suits your finances. You will recognize luxury products that should be omitted or minimized by reviewing the current expenses.

You may be shocked at how much you would save if you look at what you bought in a month and cut down on that.

It is Never Too Late to Begin

It's easy to forget about your retirement plans. Considering the busy and hectic lives people lead these days, it is no surprise that retirement planning can slip out of our minds.

However, it's important to schedule ahead of time and set realistic goals for retirement so you can enjoy the retirement life you've always hoped for.

It is always best to figure out all your investments, insurance policies, pension plans you want to take up, and any recurring medical expenditure. Once a retirement plan is in place, an individual can relax as everything is planned.

If you started saving and investing for retirement late or are yet to do so, there are steps you should take to boost your retirement savings. It is never too late to start planning.

Retirement - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Retire Grand with Flexi Benefits

- Guaranteed Lifelong Income

- Limited premium payment term

- Multiple annuity options

- Option to defer the annuity payments

Save, Dream, Plan. Live Peacefully

- 4 Plan options

- Option to choose premium payment term

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Retirement Calculator

- Best Retirement Plan

- Senior Citizen Card

- Saral Pension Plan

- NPS Withdrawal

- Pension4Life Plan

- Retirement Planning

- 5 Retirement Tips

- National Pension Scheme

- NPS Pension Calculator

- Types of Pension Plan

- Guaranteed Pension Plan

- Is Pension Taxable

- How to Check Old Age Pension Status

- Benefits of Pension Plan